Swapin Review: Fees, Features, and Payment Solutions

There are many benefits to gambling online using cryptocurrency—but it's not without its difficulties. Converting crypto to fiat money can often be very complicated and time-consuming, riddled with complexities and potential risks.

This is where using crypto payment platforms comes in. These services allow users to receive and send digital assets by enabling the automatic and instant conversion of digital currency into fiat money and vice versa. Thanks to this streamlined conversion process, gamblers can leverage their crypto holdings more easily.

In this review, we'll be discussing Swapin, a crypto payments service provider gamblers may wish to consider. By enabling swift payments and straightforward crypto-to-fiat conversions, this platform allows users to manage their digital currencies through one convenient, easy-to-use app. Let's take a closer look.

| Supported cryptocurrencies | BCH, BNB, BTC, DAI.ERC20, DASH, ETH, LTC, TRX, USDC.ERC20, USDT.BEP20, USDT.ERC20, USDT.TRC20 |

| Supported fiat currencies | EUR, GBP |

| Supported countries | EEA countries, Switzerland, UK |

| Minimum transaction amount | 5 EUR |

| Maximum transaction amount | Varies depending on financial information provided |

| Refund fee | 50 EUR |

| Licence | FVT000088 (issued by the Majandustegevuse Register) |

What Is Swapin?

Launched in 2017, Swapin is an Estonian payment processing service with a focus on crypto payments. Its number one aim is to make cryptocurrency as versatile and accessible as fiat currency. Collectively, the team behind this endeavor boast decades of experience in financial management, Fintech, and developing complex software solutions.

Swapin has a range of different products for its clientele to make the most of. Users can sell and buy crypto, convert it into fiat currency for withdrawal to their SEPA bank account, and even use it to pay for everyday expenses, such as utility bills and recurring invoices. This broad variety of services allows easy day-to-day management of crypto assets, thereby increasing the functionality of cryptocurrency.

In addition to catering to individual consumers, this service offers payment services to businesses. With Swapin, companies can seamlessly accept crypto payments and incorporate crypto buying and selling into marketplaces, exchanges, and other web pages. Businesses also have the option of joining the Swapin partnership program; by introducing individuals and other companies to the service, partners can gain up to 25% revenue share in return.

This Swapin review is primarily concerned with the experience of individual users—more specifically, the experience of those using the Swapin platform to facilitate gambling-related transactions. With this in mind, we'll move on to our next section, where we explore the specific features and services that are most relevant for these users.

Key Features and Services

This section will consider some of Swapin's key features and services, paying special attention to those beneficial for individual users looking to make gambling-related transactions.

Swapin offers five products, three for individual users and two aimed at businesses. These are:

- SwapinBuy allows the user to buy cryptocurrency from their connected bank account.

- SwapinGet allows users to convert cryptocurrency into fiat currency and withdraw it to their bank account.

- SwapinPay allows users to pay fiat invoices with crypto and transfer funds to any bank account.

- SwapinWidget allows businesses to incorporate crypto buying and selling into their dApp, exchange, marketplace, or other web page.

- SwapinCollect allows businesses to accept crypto payments.

Below, we'll consider SwapinBuy, SwapinGet, and SwapinPay in greater detail. We will also explain the two different account types and provide you with a list of Swapin's pros and cons, giving you an idea of what to expect from this service.

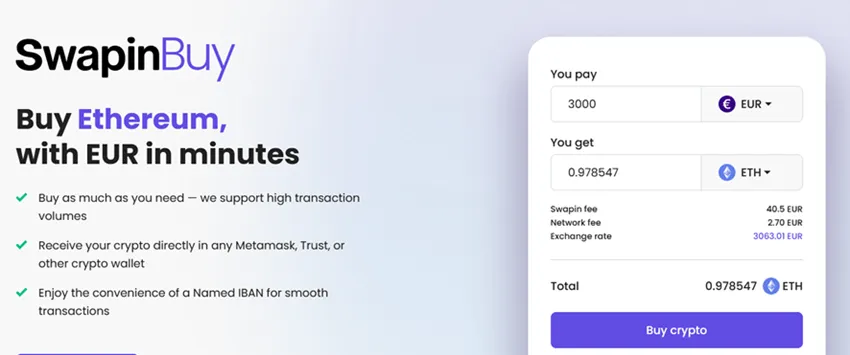

SwapinBuy

SwapinBuy enables users to buy crypto quickly and easily, making it ideal for gamblers looking to play online using digital currencies.

The process can be broken down into three quick steps, with most Swapin transactions taking five minutes or less to be processed:

- Choose the cryptocurrency you'd like to buy and input the amount you wish to pay and your crypto wallet details.

- Transfer your funds to the provided IBAN and wait for Swapin to convert them into your chosen cryptocurrency.

- Receive your cryptocurrency directly into the provided crypto wallet.

SwapinBuy's speedy transactions and ease of use are two of its most incredible selling points. Still, there are other reasons you may wish to consider this platform for purchasing cryptocurrency, such as low transaction fees. At 0.8%–1.35%, Swapin's transaction fees are highly competitive in today's market.

Users are also afforded much flexibility in how much they spend on cryptocurrency. The Swapin platform has a low minimum transaction amount of 5 EUR, but it is capable of supporting large transactions, too, with maximum transactions of 10M EUR.

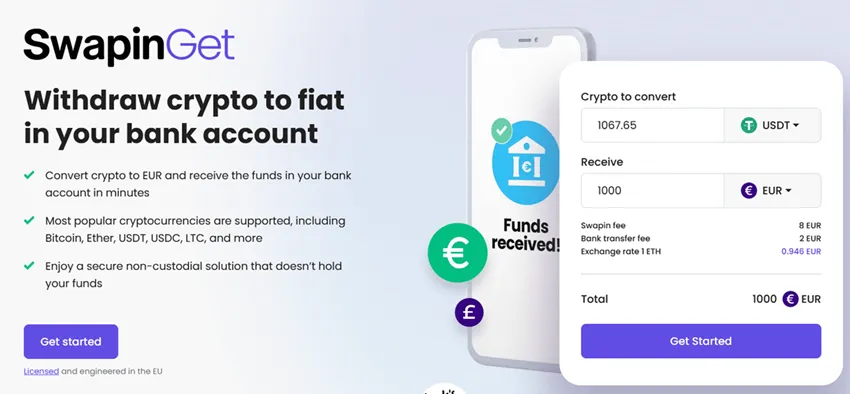

SwapinGet

SwapinGet allows users to transfer crypto to fiat and withdraw these funds to their bank account. This process is as quick and straightforward as purchasing cryptocurrency using SwapinBuy.

It is ideal for gamblers who frequent crypto casinos looking for a way to convert their winnings quickly. To transfer crypto to fiat money and withdraw it to your bank:

- Choose which cryptocurrency you'd like to withdraw as a fiat currency.

- Create a SwapinGet wallet for the cryptocurrency, providing the details of your chosen bank account.

- Send assets from your crypto account to your SwapinGet wallet and wait for your funds.

When transferring funds with SwapinGet, users benefit from a low bank transfer fee of 0.2% and a Swapin fee of 0.8%, making this service very affordable.

As with SwapinBuy, the minimum amount you can transact is 5 EUR, but there is currently no upper limit to how much you can withdraw, depending on the account verification level.

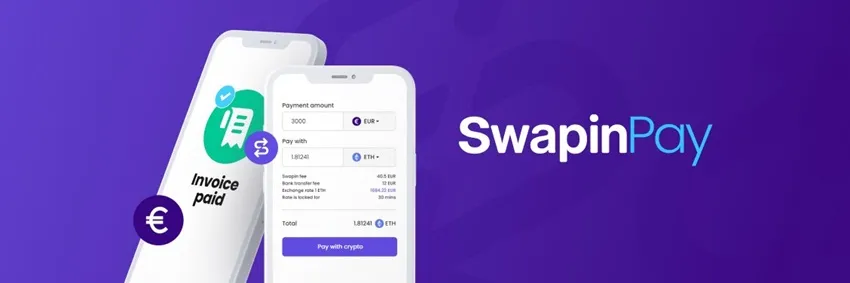

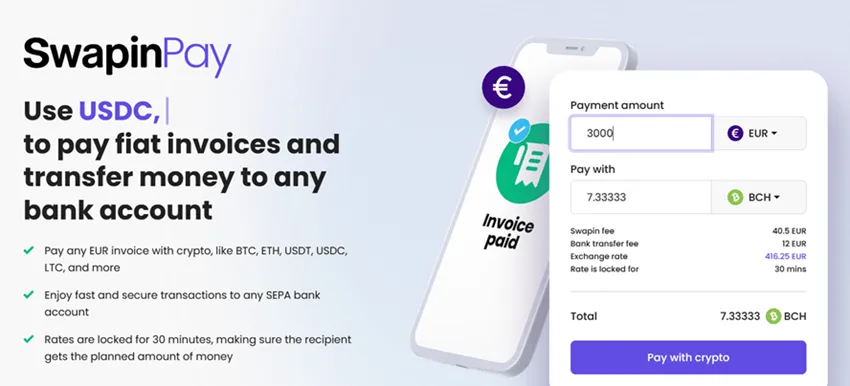

SwapinPay

The final Swapin product we'll consider is SwapinPay, which allows customers to use cryptocurrency to pay monthly rent, settle utility bills, and more.

This service can pay any EUR invoice, including those from online casinos and gambling sites. SwapinPay allows for quick and easy transactions that can be completed in just a few clicks:

- Select the cryptocurrency you'd like to use for the payment and input how much you want to pay, providing the recipient's IBAN account details.

- Transfer your cryptocurrency to the provided wallet.

- Please wait for the recipient to receive the funds in their bank account.

With SwapinPay, you'll benefit from low transaction fees starting at 0.8%. Another benefit of using this service to transfer money is that you'll have a period of 30 minutes where exchange rates are locked, meaning the recipient will receive precisely the amount they should.

Account Types

Only two types of accounts are available through Swapin: personal and business. Regardless of which type you'd like to open, registering an account on the Swapin platform is free.

Both businesses and individuals must verify their identity before they can get started. Business accounts have one verification level, whereas personal ones have three: Starter, Full, and Full+. In a later section, we will explain what each level of verification entails and its benefits.

Pros and Cons of Swapin

When gambling online, many people choose to use cryptocurrency, whether because of its high degree of privacy, fast transaction times, or robust security features. If you are one of these individuals, you'll no doubt want a reliable payment processing provider to help bridge the gap between your crypto wallet and your traditional banking system.

To help you determine whether Swapin solutions are the right match for you, we've pulled together some of the main pros and cons for your consideration:

| Pros | Cons |

|---|---|

| Accepts loads of cryptocurrencies | Few fiat currencies |

| Supports high-volume transactions | Some features require full verification |

| Secure and EU-licensed | Limited global availability |

| Speedy transaction times | No 24/7 support |

User Experience and Interface

Information regarding Swapin user satisfaction within the gambling community is minimal, but when looking at user reviews more broadly, it is very popular. The company boasts a 4.4/5 star rating on Trustpilot, based on over 260 reviews, many of which praise the service's fast transaction times and ease of use. Feedback elsewhere on the web echos these sentiments while also highlighting Swapin's dedication to transparent and trustworthy service.

Overall impressions of Swapin's customer support service seem a little mixed. On the one hand, we found some positive customer feedback praising the team's helpfulness and general efficacy; on the other, some complained of long wait times between messages. This could be because Swapin's customer support live chat from Monday to Friday, between 9 AM and 5 PM EEST. This may be problematic for some; 24/7 live chat services are becoming increasingly common in the world of online gambling, so a lack of one is a little disappointing.

But all things considered, Swapin has proven itself as a popular, reliable payment service with a high degree of app usability, helpful customer support staff, and a great user satisfaction score. This is good news for gamblers looking to use the service, as they can trust that their funds are in safe hands when using Swapin payment solutions.

Comparative Analysis

Swapin may be doing well for itself, but other popular payment services also accept crypto payments. How does Swapin stack up against them?

In this section, we'll weigh Swapin services against those of its two key market competitors: Neteller and Skrill. In the table below, we compare all three platforms, contrasting their supported currencies, transaction speeds, and fees, among other important points for consideration:

Platform | Swapin | Neteller | Skrill |

|---|---|---|---|

Platform Supported crypto currencies | Swapin 10+ | Neteller 40+ | Skrill 40+ |

Platform Supported fiat currencies | Swapin 2 | Neteller 25+ | Skrill 40+ |

Platform Transaction speed | Swapin Under 5 mins | Neteller Instant | Skrill Instant |

Platform Transaction fees | Swapin 0.8%–1.35% | Neteller 1.3-1.5% | Skrill 1.5% |

Platform Integration with casinos | Swapin Yes | Neteller Yes | Skrill Yes |

Platform Withdrawal limits | Swapin 4,000 EUR per month - No limit | Neteller Varies between accounts | Skrill Varies between accounts |

Platform Global availability | Swapin 190+ | Neteller 200+ | Skrill 200+ |

Platform Special features | Swapin Simple interface, named IBANs, make recurring payments | Neteller VIP program, 24/7 support, contact upload | Skrill VIP rewards program, welcome bonuses, virtual assistant |

There are two main differences between Swapin and these two major platforms. Firstly, Neteller and Skrill both support more currencies, both crypto and fiat. Secondly, they offer special features that Swapin doesn't, including VIP programs and other bonuses.

However, these differences don't necessarily reflect a failure on the part of Swapin. Keep in mind that the platform has only been around since 2017, whereas both Neteller and Skrill were established over twenty years ago. As a result, they are much larger companies with more manpower and more resources. Despite these differences, Swapin manages to compete with them in many other areas, including transaction speed, transaction fees, and more.

Registration and Verification Process

As previously mentioned, registering with Swapin is entirely free, whether you're signing up for a personal or business account. After hitting the "Sign Up" button on their website, companies will be asked to provide details for the Swapin team to review, including full name, email address, country, and company description.

Users registering a personal account will only be asked to provide an email address and password. After providing the necessary information, they can access the site and start the verification process.

In a previous section, we touched on the fact that personal accounts could have three levels of verification: Starter, Full, and Full+. Swapin advises users to go for the lowest tier first and upgrade later on, as that will allow them to start using the site immediately.

Below, we've broken down these three verification tiers, describing the requirements and benefits of each:

| Verification level | Starter | Full | Full+ |

|---|---|---|---|

| Requirements | ID | ID + proof of address | ID + proof of address + financial information |

| Time required | 2 mins | Varies | Varies |

| SwapinBuy features | Up to 10,000 EUR monthly | Up to 20,000 EUR daily / 35,000 EUR monthly Named IBAN | Limits based on financial information Named IBAN |

| SwapinGet features | Up to 4,000 EUR monthly Payments made to own account | Up to 5,000 EUR daily / 15,000 EUR monthly Payments made to any account | Limits based on financial information Payments made to any account |

| SwapinPay features | Up to 4,000 EUR monthly Payments made to own account | Up to 5,000 EUR daily / 15,000 EUR monthly Payments made to any account | Limits based on financial information Payments made to any account |

The verification process usually goes smoothly, but some users may encounter delays or have their applications rejected altogether. This usually happens because of a lack of proper documentation. To avoid any such difficulties, we recommend:

- Familiarizing yourself with all verification guidelines.

- Ensuring you verify yourself using a valid form of ID (i.e., government-issued photo identification).

- Checking your email inbox regularly for updates or further document requests.

Security and Compliance

Of course, our Swapin review wouldn't be complete without considering the company's security and compliance measures. These are matters we have already touched on in some sections, but here we discuss them in greater detail.

With licenses from the Majandustegevuse Register and the EU, Swapin has established itself as a trustworthy provider of crypto payments. The company is also committed to upholding the highest possible standards of compliance, including adherence to Anti-Money Laundering Directive 6 (AMLD6). Swapin regularly undergoes audits to ensure they are meeting these standards, and to verify that their security methods stand up to scrutiny.

In the online gambling industry, secure and trustworthy transactions are of paramount importance. Should a payments service provider fail to properly manage customer data, that customer stands to risk identity theft, fraud, and account compromise. All the available evidence shows that Swapin takes every possible precaution to mitigate such dangers. So, if safety is one of your top priorities when choosing a platform for managing your personal digital assets, we strongly recommend this one.

Final Thoughts

This Swapin review has explained all the platform's main features, weighed up its pros and cons, and measured it against two of its greatest market competitors. Now, we finally come to the more important question: do we recommend Swapin? As you may have guessed, our answer to that question is a resounding yes.

No platform is perfect, and measuring Swapin up against the competition did reveal a couple of weak areas. Even so, this service has so much to offer; there's every reason to expect it will catch up with its competitors in the years to come. We were especially impressed by all the positive customer reviews we found during our research, as well as Swapin's clear dedication to security and transparency. If you're willing to sacrifice some of the special features offered by some of the larger payment platforms, we'd definitely recommend giving Swapin a shot.

FAQ

Can I use Swapin in Crypto Casinos?

You can use Swapin to buy cryptocurrencies to use at crypto casinos. Likewise, you can use this platform to transfer crypto into fiat currency, ready to withdraw it into your bank account.

What Cryptocurrencies Are Accepted with Swapin?

Currently, Swapin accepts twelve types of cryptocurrency. These are BCH, BNB, BTC, DAI.ERC20, DASH, ETH, LTC, TRX, USDC.ERC20, USDT.BEP20, USDT.ERC20, and USDT.TRC20.

What Are the Verification Requirements for Using Swapin?

Personal accounts have three levels of verification available for users: Starter, requiring just your ID; Full, requiring ID and proof of address; and Full+, requiring ID, proof of address, and some financial details.

Are the Transactions Fast?

Transactions made via Swapin are very fast, taking less than 5 minutes to be fully processed. Some of the major payment services may offer slightly faster times, but Swapin’s are still competitive despite the company’s relatively small size.

What Are the Transaction Fees and Limits?

Swapin boasts low transaction fees of 0.8%–1.35%, which is significantly less than those of its competitors. Transaction limits vary between different verification levels. Starter accounts can buy up to 10,000 EUR of crypto and withdraw up to 4,000 EUR every month. Full accounts can buy up to 20,000 EUR daily or 35,000 EUR monthly and can withdraw up to 5,000 EUR daily or 15,000 EUR monthly. Full+ account limits depend on the financial information given.